#Outbank cnpj Offline#

#Outbank cnpj update#

Always be up to date with the automatic account update and notifications.Simply add your current accounts, instant access savings accounts, credit cards, stock portfolios and digital services like PayPal to the app Features With the new Outbank you can keep an eye on all your finances at all times with only one app. Of course, you can also manage your PayPal or Number26 account with Outbank. The best about it: your data can be synchronized between all your devices - secure with end-to-end encryption.Īll major German, Austrian and Swiss banks are compatible with Outbank. You can use Outbank on your iPhone, iPad and Mac. With Outbank you carry an overview of all your bank accounts and transactions with you at all times. Please contact our attorneys for more information on this matter.Outbank unites all your bank accounts and credit cards in one app.

#Outbank cnpj password#

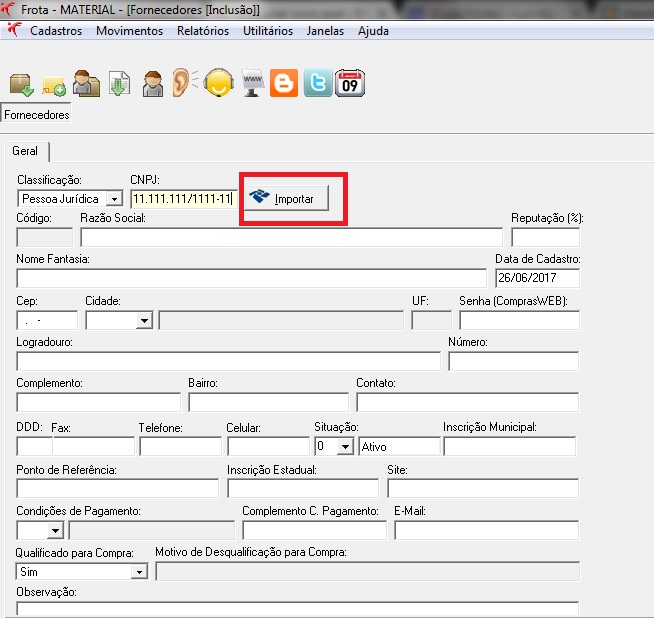

Such process involves scheduling via password for commencement of a prior administrative process, with transmission of documents (digital dossier) and Basic Input Document (DBE) digitally on the e-CAC portal, with access via Digital Certificate.

#Outbank cnpj registration#

It is important to highlight that failure to comply with the obligation to report information on the final beneficiary of foreign entities by the above deadline will entail suspension of the CNPJ and being prevented from carrying out bank transactions here.įinally, we would alert that the procedure for inclusion of a final beneficiary in the foreign entity’s corporate tax registration here is not a speedy process and depends on analysis of documents on such final beneficiary by the RFB. By the same token, those that prior to Jwere already inscribed on the CNPJ now have the obligation to indicate the final beneficiary upon carrying out any alteration in the CNPJ of the foreign entity, those that have not carried out any alteration since that time now have a deadline that terminates on December 31, 2018. Identification of the final beneficiary became mandatory as from July 1, 2017, upon inscription of the foreign entities on the CNPJ. An individual with significant influence is one who “possesses more than 25% (twenty-five per cent) of the foreign entity’s capital, either directly or indirectly or who predominates in corporate decision-making and has the power to appoint the majority of the foreign entity’s administrators, either directly or indirectly, even without controlling it”. In turn, the new Normative Instruction requires that information be provided to the RFB on the final beneficiary of overseas structures (foreign investor), which is defined as “the individual that, at the final level, directly or indirectly owns, controls or significantly influences the entity” or “the individual on behalf of whom a transaction is conducted”. Now it is mandatory to include information on the final beneficiary of a corporate entity in the CNPJ database for foreign entities that have or file for inscription on such tax registration roll in Brazil. RFB/IN 1.470/2014, 1.511/2014 and 1.551/2015) and altered the regulations for registration and maintenance on the nation’s Corporate Tax Registration Roll (CNPJ). RFB/IN 1.634 of May 6, 2016, revoked the agency’s previous Normative Instructions (Nos. Brazilian Federal Revenue Bureau (RFB) Normative Instruction No.

0 kommentar(er)

0 kommentar(er)